PropNex Picks

|November 07,2025Unlocking Up to $230,000 in Housing Grants: A First-Timer's Guide

Share this article:

Buying your first home can be intimidating, especially when it comes to financing. Between LTV limits, MSR, TDSR, and all the paperwork, it's easy to lose track of what really matters: how to afford it.

Fortunately, if you're buying an HDB flat, there's good news. The government offers a range of housing grants that can lighten your financial load. And if you know how to navigate them (the legitimate way, of course), you could unlock six digits' worth of savings.

That's not pocket change. It's real money that could make your dream home a whole lot more affordable.

So if you're a first-timer, make sure to save this guide.

Luckily for you, in our public housing ecosystem, first-timers get good support. The government has measures in place to make sure homeownership stays within reach of its people.

There are three main grant types that you need to know:

- CPF Housing Grant for Resale Flats (Singles and Family Grants)

The CPF Housing Grant provides financial help to first-timers who want to purchase a resale flat. It's especially useful for those who prefer a ready home instead of waiting years for a new flat. Both families and singles can qualify, though families get up to $80,000 and singles up to $40,000, depending on income and flat type. If eligible, you can stack this grant with others like the EHG and PHG.

- Enhanced CPF Housing Grant (EHG)

Unlike the CPF housing grant, the EHG applies to both new and resale flats. The grant amount varies based on your income. This means the lower your average household income, the higher your payout. The good news is, in August 2024, the grant limit was increased. So now families can receive up to $120,000, while singles can get up to $60,000.

The EHG aims to bridge affordability gaps, especially for lower- to middle-income households, so they can access well-located homes without being priced out. What you should note is that the grant amount tapers gradually. The higher the monthly income, the less the grant amount. It's HDB's way of ensuring support goes where it's most needed, while still rewarding financial prudence among first-time buyers.

- Proximity Housing Grant (PHG)

The PHG helps singles and families buy a resale flat to live near (within 4 km) or with their parents or children. Families can receive up to $30,000, while singles can get up to $15,000. Beyond its financial perk, the PHG also supports multigenerational living and care, which is becoming more relevant in Singapore's ageing society. You can also click here to check your proximity/distance.

---

If you add these all up, you're looking at up to $230,000 for families and up to $115,000 for singles!

To give you a better idea of how the grants work, here are some examples.

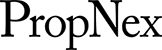

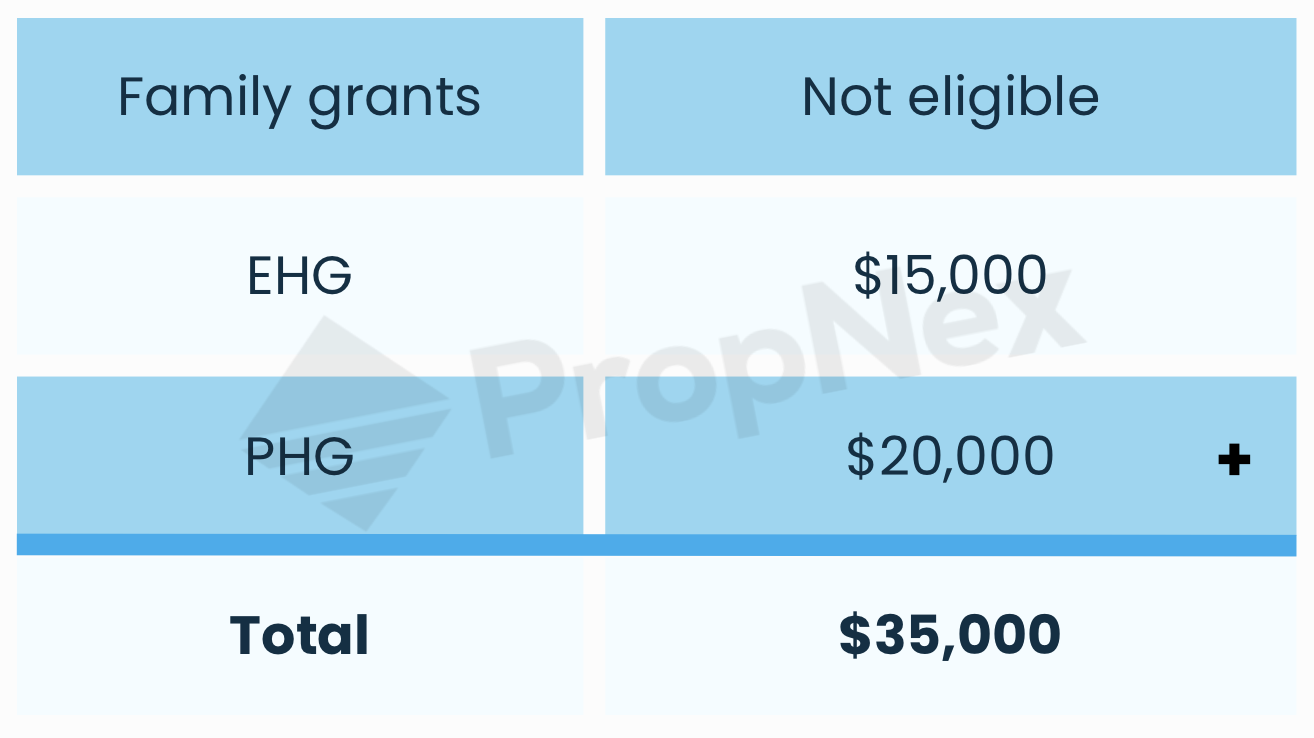

Example 1: Married couple, both Singaporean citizens, both first-timers, buying a 4-room resale flat near their parents. Their combined income is $5,000/month.

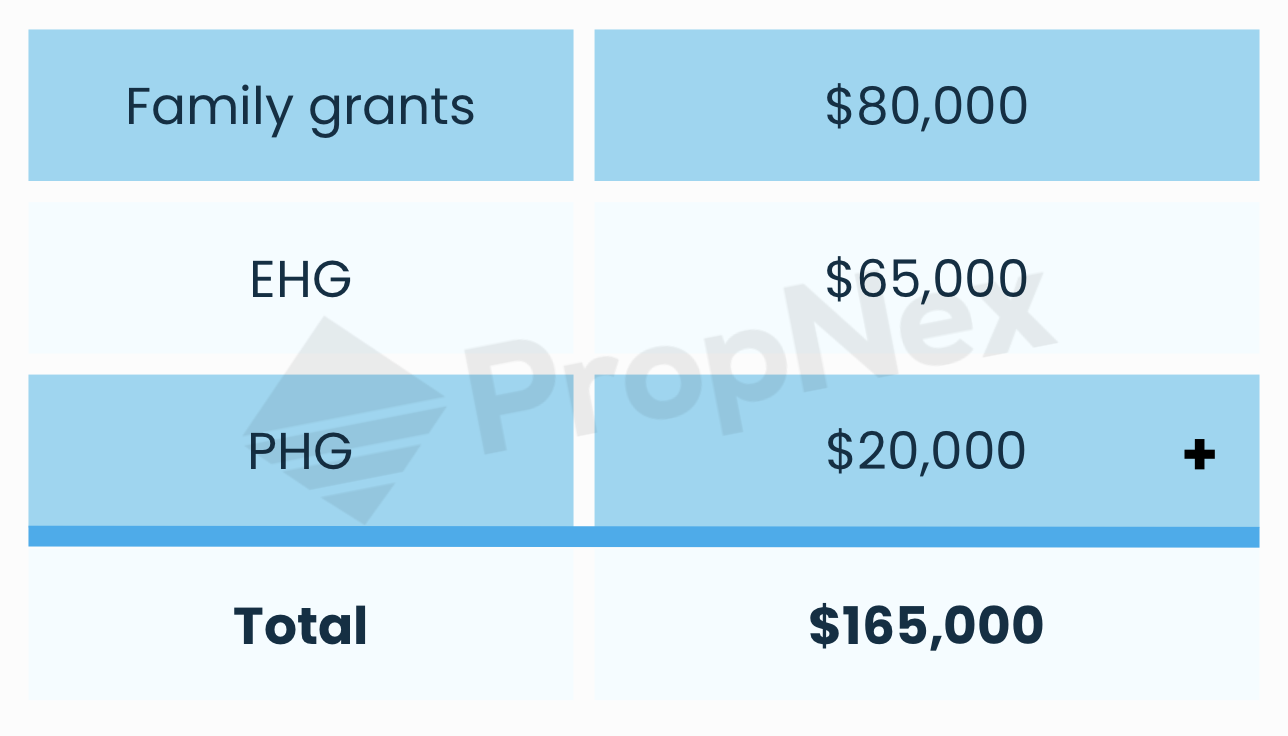

Example 2: A single Singaporean citizen, buying a 3-room resale standard flat with parents. The monthly income is $3,000/month.

Example 3: Married couple, first-timer and second-timer household, buying a BTO flat near their parents. Their combined income is $7,000/month.

The government has extended their support. Now all you have to do is make the most out of these grants. So here are some things you can consider before you apply.

- Understand what you're eligible for

Each grant comes with its own set of conditions, from citizenship status to income ceilings. It's worth taking a few minutes to review the full breakdown and eligibility details. Luckily for you, we have it all laid out right here.

- Start as early as you can

Timing can make a real difference, not because the grant rules change, but because your income does. The EHG gives you a bigger payout when your average household income is lower. So the earlier you buy (when you're earning less), the more support you can get.

Here's an example. Let's say there are two couples.

Couple A, both 27-year-old first-timers, is buying a 4-room resale flat. They earn $4,000/month combined, which means they qualify for $55,000 in EHG.

Couple B (also first-timers) wants to wait until they earn more. By 32, their combined income is $8,500, which means they can only get $10,000 in EHG. They are also looking for resale flats, but because they waited, prices have gone up. Not only did they lose momentum in the market, but they also got less EHG.

So, which couple is better off?

- Plan around income ceilings

Both the CPF Housing Grant and EHG are assessed based on your average monthly household income over the 12 months before your flat application, not just your latest payslip. That means the timing of your application can somewhat influence your grant amount.

For example, if you apply for a flat right after you received a bonus or pay raise, it could push your 12-month average above a grant tier. Waiting until those higher-earning months "age out" of your assessment window might help you qualify for a larger grant.

Of course, only you can decide if it's better to "lose time" or receive less grant. Another thing you can do is exclude temporary income, if any.

- Decide between new and resale flats

New flats or BTOs typically offer subsidised prices plus EHG. Meanwhile, resale flats allow you to stack more grants together since the CPF Housing Grant is only for resale flats. If you find a resale unit that ticks your boxes and is near your parents (for PHG eligibility), your total financial benefit may actually be higher than buying a new flat.

- Study the market

Grants can help you get started, but they shouldn't be the only factor driving your purchase. Take some time to understand where prices are headed and how different estates are performing.

Beyond prices, consider long-term value. A slightly more expensive flat in a growth area with upcoming MRT lines or town rejuvenation plans could appreciate more over time, offsetting the smaller grant amount. On the flip side, a cheap older flat with a shorter lease might save you money now but limit your resale options later.

If you're unsure where to start, ask your property agent about resale performance in your preferred towns. At PropNex, we use proprietary tools like the PropNex Investment Suite, which tracks real-time market data on price trends, transaction volumes, and growth potential. With insights like these, you can make data-backed decisions and see exactly how each grant stacks up against long-term value.

While maximising grants is smart, there are things you need to remember and common mistakes to avoid.

- Grants are not cash payouts

They're credited into your CPF OA and used to offset the purchase price or reduce the housing loan to purchase the flat.

- They must be refunded with accrued interest upon resale

When you sell your flat, the grant PLUS CPF interest goes back to your CPF account. This often surprises first-time sellers, so if you're unsure how accrued interest works, here's a short clip to help you understand it better.

- Older resale flats may reduce CPF usage

Older resale flats can come with trade-offs that aren't always obvious at first glance. Because their leases are shorter, you might not be eligible for the grant if the remaining lease doesn't cover the youngest buyer to age 95. On top of that, maintenance costs for ageing flats tend to be higher, and some older units are even priced at a premium precisely because they qualify for stacked grants.

That's why it's important to weigh the pros and cons carefully. Ask yourself this: will the grant amount you receive today be enough to sustain your flat in the long run? From renovation costs to future upkeep? Getting a big grant may feel like a win, but not if it costs you later.

- Current property ownership may disqualify you

If you own more than one non-residential property or any private property, you must sell it and wait 30 months before applying for an HDB flat with grants.

- Weigh your options carefully

Sometimes, maximising your grants can have some trade-offs. For example, say you've always dreamed of living in Tiong Bahru, but your parents stay in Bishan. The two estates are more than 4 km apart, which means you won't qualify for the PHG if you buy in Tiong Bahru.

That's when you'll need to weigh what's more important: getting the lifestyle and convenience of your dream neighbourhood, or enjoying the extra grant support from living closer to family.

Buying your first home should not be intimidating. With the right understanding of how HDB grants work, you can take your first confident step toward homeownership.

Whether it's the Singles/Family grant, the EHG, or the PHG, each grant exists to make your path a little smoother. The key is to plan intentionally and make smart choices. Your first home isn't just where you live, it's where your financial journey begins. Make it count.

If you'd like to take your planning one step further, join us at the upcoming PropNex Wealth Seminar (PWS) Masterclass. You'll learn more than just grants and CPF. We're talking long-term portfolio growth, exit strategy, and how each decision today can impact your wealth journey tomorrow.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.